We have gathered some information to fill you in with the know-how, as it might not be known to you that you may be contributing a fair sum of your own pay packet to your workplace pension by 2018.

What is a workplace pension?

A workplace pension is arranged by your employer and is in addition to the state pension you will receive when you retire. You may already have a pension scheme, but by 2018 all employers will need to offer a workplace pension for its employees. The maximum state pension for a single person is currently: £115.95 per week per person. You can receive this pension on top of a workplace or other pension.

The basics:

- A percentage of your pay is put into a scheme every month, in most cases your employer contributes a percentage and you get tax relief from the government.

- When you are able to receive this money depends on the scheme’s rules (usually the earliest is 55).

- Dependent on the type of scheme your employer offers you can opt to receive on lump sum if the money is a small amount, you can take 25% of that tax-free. You do however pay income tax on the rest.

- You receive this pension in addition to the state pension.

When will this be enforced?

This new system is being introduced over a period of 6 years; the first wave has already begun with larger companies now offering workplace pensions. Smaller businesses will have longer to prepare, but eventually, the idea is that even the smallest of operations will be required to offer a workplace pension.

To find out when your companies staging date will be, you can use this tool: staging date calculator. This is mainly for the use of employers but does also work for employees (if you know your PAYE reference). If your employer does not use the PAYE scheme your staging date will be 1st April 2017.

How will the scheme work?

If you are automatically enrolled a percentage of your pay will be added to your pension fund each payday. Your employer will add a percentage to this and you will receive tax relief from the government.

Who is eligible?

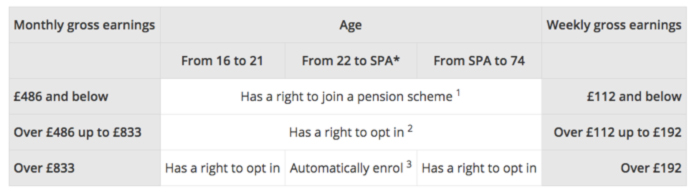

Employers must enroll all employees who are:

- Aged between 22 and state pension age.

- Earn more than £10,000 per year.

- Work in the UK.

Breakdown, what you, your employer and the government pay:

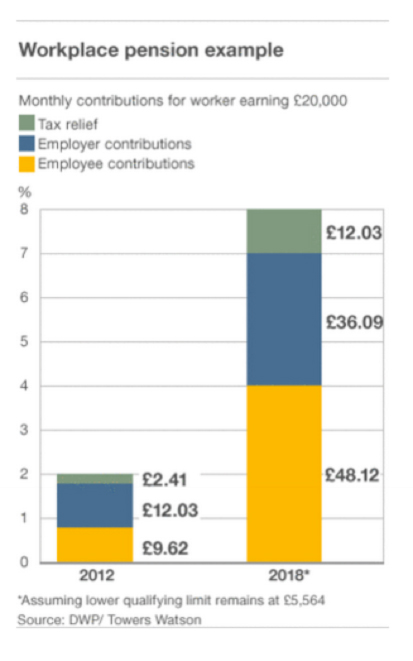

For example monthly contributions for a worker earning £20,000 p/a, monthly contributions would (by 2018) be 4% of your earnings either between £5,824 and £42,385, or your entire salary before tax (depending on which plan your employer opts for). In this example the qualifying earnings are between £5,824 and £42,385, this comes to £48.12.

This amount is then supplemented with 3% that your employer contributes which, in this example is £36.09.

In addition to this the government adds 1% tax relief, in this case it is £12.03.

The total amount paid in per month is £96.24.

Changes to your take home pay:

To begin with an employee will only contribute 0.8% off their ‘qualifying earnings’, the employer then contributes 1% and then tax relief adds another 0.2%.

These amounts will then increase to a minimum 4% contribution from the employee, 3% from the employer and 1% tax relief in October 2018.

This totals at 8% of a workers earnings (including overtime, excluding earnings over £42,385).

Your take home pay will reduce as a result; exactly what you pay will depend on which plan your employer chooses to enroll you in. The amount you pay will be relative to your ‘qualifying earnings’ this is defined as the amount you earn before tax between £5,824 and £42,385 a year or you entire salary/wages (before tax).

This is now an employer duty, if your company fails to comply a notice and/or penalty will be issued. To see more information on workplace pensions for both employees and employers visit, www.gov.uk/workplacepensions.